How To Put On Merle Norman Check Crayon

Cryptocurrency scams are happening daily in the crypto world, affecting thousands of users similar you. Inpart I of this mini-series we talked most the importance of due diligence and some important tools likeTokenSniffer and BscScan/Etherscan which can be used to investigate a token'south legitimacy and aid you avoid being rugged.

If you haven't read part one of this article, we suggest yous read that first as it'southward got lots of great information. Find part I here.

Infunction Ii we'll take a more in-depth look at some tools, ideas, and strategies you can apply to detect and avoid scams whilst trading new token releases on DEXs such as PancakeSwap and UniSwap.

Table of contents

- Scam Tokens

- Some More than Tools to Examine the Contracts

- Manually Examine the Contract

- Manually Search Through the Contract

- Cheque the annotate section for information in the contract (the head/top of the contract)

- Check the Liquidity Pool

- Locked or Burned LP Tokens?

- How LP Tokens Work —

- Burning LP tokens

- Locking LP tokens

- How to Check if the LP Tokens are Locked?

- How locked tokens look on BscScan/Etherscan

- Await at the Holders

- Summit receivers (from programmer wallets)

- What to do?

- Scam coin or non? Do a exam (dip your toe in)

- The Nigh Ideal Situation… and Tying it all Together

- Conclusion

Scam Tokens

When searching for all-time new crypto to purchase, your modus operandi for all tokens should be toASSUME it'south a scam unless otherwise proven then, every bit the vast majority of new small-cap tokens will probably be scams. Therefore, it'southward safest to just adopt the mindset of assuming that up to 99% of new tokens will be scams, and that near projects are just vehicles to siphon money out of your wallet.

New cryptocurrency launch is always exciting, but can be extremely dangerous for crypto users. Quick and easy coin is the reason why some developers and crypto scammers are releasing new tokens and coins so often. It is easy and can bring huge profits for these scam devs.

So ALWAYS practice your due diligence before aping in!

Some More Tools to Examine the Contracts

The token contract AKA "smart contract" is basically the "rules" of how the token works, and scammers can write all sorts of nasty tricks into them, such as mint functions or limiting the ability to sell (honeypots).

An excellent tool to check out is BSCheck– it's easy and free to use, simply paste the token contract address into their website and it'll exercise a health check on the requested contract and alert you lot of any potential issues.

BSCheck (http://www.bscheck.european union) looks for mutual scams and problems like:

- Honeypot code:The scanner volition detect if only certain wallets(dev wallets) are allowed to sell.

- Contract owner:If there is withal a contract owner, that person could modify the lawmaking at whatsoever-fourth dimension. Renouncing ownership over the contract is a common style to show that the owner isn't upwardly to anything devious.

- Programmer wallet info:How much of the token supply do the developers and team members hold? This is important because, if they hold a large pct of the tokens they could potentially "rug" the project by dumping their tokens on the open up market.

Notation– Simply because developers and team members hold a large portion of the tokens, does non always hateful information technology's a scam, but it's just something to be aware of.

Manually Examine the Contract

Head over to BscScan or Etherscan and check out the contract source code

The first thing you lot'll want to bank check is the "Compiler Version"- About scams volition have an older compiler version,typically v0.five.17 (for BEP-20 tokens).

Note that in the future this may alter, just exist aware that scams may exist using older compiler versions. Furthermore, just because it's made on the newest, or a newer compiler version, does not mean it isn't a scam!

As you lot tin see in the picture higher up, PUG_DADDY usedv0.6.12, but it turned out to be a scam.

The most recent compiler for Solidity Compiler that ETH and BSC tokens utilize is five.0.8.10 at the time of writing this.

Scam tokens very often acceptv.0.five.17(probable to 100% be a scam) andv.0.6.12(90% possibility of a scam)beingness the nearly common versions constitute in scam contracts. If you see a token with these compiler versions, avoid them!

Manually Search Through the Contract

What you lot'll desire to type in when searching the contract is:

- "role mint"

Themint() office allows the contract owner to create new tokens whenever they want. Keep in mind that this may be needed for some legitimate projects that for instance accept rewards or farming options.

- selfdestruct (this is a less common function, and probable to exist removed in the time to come rollouts of solidity)

Selfdestruct will allow the contract to be destroyed and and then replaced by another completely unlike contract. Meaning a programmer could create a actually overnice looking contract with a selfdestruct function, and and then replace it at any moment with a totally unlike contract that is set up up to exist a honeypot or rugpull.

We don't see this selfdestruct role oftentimes, but it's nonetheless something to exist aware of.

Legitimate tokenssometimes, but not always,have relevant information about the contract at the starting time of information technology. This information may explain WHY at that place is a mint function (for farms or rewards) or it may give you details well-nigh their website and other project info; (TG link, twitter, website links, etc).

NOTE:Many legitimate tokens don't have this information at the elevation of their contract, so this is just a pocket-sized affair to be aware of. It'southward simply squeamish to see that the developers or team took the extra pace to put that information in there.

When you do encounter that kind of information in in that location, it should bolster your confidence in the projection, still the links in such comments may too lead to fake websites, Telegram groups, etc.

Another thing to cheque is thedate the contract was submitted for verification.

IF the contract has several dates(more than than one), this tin can be a red flag to stay away. It means they basically copied another contract, and re-submitted it for verification, hence why it shows twice.

Bank check the Liquidity Puddle

Here's how you check to come across whether or not the liquidity tokens/pool looks safe.

But first, why is liquidity important?

- Liquidity: Who owns the liquidity tokens? This is of import because if someone has control over the LP tokens, the other token holders can be rugged.

- Top token holders:It's useful to run across if there are whatever large wallets holding a significant share of the tokens, for obvious reasons, equally large token holders can hands rug, or tank the price by dumping all their tokens and pulling the other (more than valuable token), from the trading pair.

Locked or Burned LP Tokens?

Having a look at whether the liquidity puddle tokens are eitherlocked, orburned are 2 of the best means to avoid getting rugged on a project. What is Locking or burning y'all say?

Developers taketwo options to show that their projects are not rug pulls:

They can eitherlock the tokens for a specific time period, orburn all of and/or a percent of the LP tokensthat they own.

If y'all notice that a project has done either of these, y'all tin experience more condom considering they won't be able to carpet-pull on y'all, using their LP tokens (there are still other means though!)

How LP Tokens Work —

When developers want to create liquidity for their project, then that people can trade their token, the developers must commencement provide a token against which their project tin exist traded. A common example of this is what we call a "trading pair"- SHIB/USDT, MYTOKEN/BNB, AAVE/ETH, then on.

For example, a prospective projection would have to provide both MYTOKEN and some BNB tokens, in order to create an LP token.

Therefore, the developer must put up some BNB tokens in conjunction with MYTOKEN in order to create a LP token and make their project tradable on a DEX such as PancakeSwap.

When the developer provides the funds that allow people to trade, they in turn receive some amount of LP tokens, which provides ownership over some office of the whole liquidity pool. In our case above, the developer provides MYTOKEN and BNB in exchange for an LP token that demonstrates buying of what they put in.

Essentially, LP tokens are the "proof" that they own a portion of the liquidity puddle, and they can exchange these LP tokens for their stake in the liquidity pool at any time, hence why it'due south important that these tokens be locked or "burned" as it denies the developers the ability to rug the project and or remove liquidity at volition.

Think of information technology sort of like when you go to a dry cleaner. When you bring your clothes in for cleaning, you'll get a ticket or receipt saying which set of dress are yours. When y'all come dorsum to pick upward your clothes, you show the ticket/receipt and then you lot go your clothes back!

LP tokens piece of work similarly in that you put BNB+MYTOKEN in, and in exchange you go an LP token that says "this is how many BNB tokens and MYTOKEN tokens you lot put in." There is likewise a very important topic of theimpermanent loss which matters to all LP providers, stakers and yield farmers, just we'll not discuss information technology here. Just proceed in mind that if you ain LP tokens — you can be rugged every bit well. If some Bob exchanges a huge amount of their worthless MYTOKEN for BNB, so all the LP providers would now own "about aught BNB and manner more MYTOKEN tokens than they put in", and your LP tokens accept now lost all the value, considering Bob drained all BNB out of the pool.

With regards to our dry-cleaner example it's the same as someone bringing a bunch of faux tickets and taking all other people'south dress.

Locked liquidity and burned LP tokens in general are skilful because the developers/squad no longer have access to the liquidity pool tokens, pregnant they CAN Non remove the liquidity from the DEX.

Burning LP tokens

The more than secure manner to avoid a carpet pull is for the LP tokens to be burned. This is accomplished when developers send their LP tokens to a burn down address.

A burn accost that is often used is 0x000…00dEad. (note the dead at the terminate of the address). SOMETIMES, the burn address will just contain zeros and no "dead" at the cease.

Below you can see an instance of a token that burned 50% of their LP tokens

Note-If a programmer burns 50% of the tokens but keeps the other 50% they'll still essentially own 100% of the liquidity, which would make it very easy for them to rug the project.

Locking LP tokens

Another common way to evidence adept organized religion is to lock the LP tokens into a smart contract. Typically, in that location is a time limit for how long the tokens are locked, and it is ordinarily made known to the public (one yr, six months, etc.)

Annotation– Some projection may "fake" lock their tokens past only locking them for a few days, so information technology's important to verify this!

How to Check if the LP Tokens are Locked?

Cheque out https://deeplock.io/prophylactic to see tokens that use theDeepLock liquidity locker.

This tool volition tell you what percent of the token supply is locked and for how long.

Go along in mind this isn't the merely tool to see if tokens are locked or not.

How locked tokens look on BscScan/Etherscan

Sometimes you'll see an icon(looks similar a trivial piece of paper) next to a contract accost,which may bespeak that tokens are locked.

Information technology might expect like this:

NOTE-Locking and burning tokens takes some time. If you spot a token listed inside the first few minutes but don't run into the LP tokens locked or burned notwithstanding, it does not necessarily hateful information technology's a scam! It could but hateful the developer has nevertheless to lock/burn down the tokens, and so just check back sometime later on to verify.

Unicrypt

Some other tool to cheque out if the LP tokens are locked isUnicrypt — this tool allows you lot to check tokens beyond multiple DEXs (PancakeSwap, Uniswap, QuickSwap)

It's an outstanding tool that's super easy to use! We highly propose you make use of information technology when doing your enquiry well-nigh a token.

Look at the Holders

First, head over to BscScan or Etherscan and cheque out the holder folio.

Looking at the token holder page will give you a skillful idea of what the developers accept washed with the tokens, who holds a lot of the tokens, and other useful data.

In the example above you lot tin see that a large portion of the tokens take been sent to a burn address, which is usually a good thing, reducing the number of available tokens and making the tokens that are left more valuable.

Below that (the 2d address) you lot tin can run across a large number of tokens. It's not clear what the wallet is for, but it may have some purpose such equally swapping an older version of tokens to new ones.

When looking for best cryptocurrency to buy, it is ever a good idea to scrutinize these holdings and transactions,because as mentioned in a higher place, developers can "fake" burn LP tokens. Meaning they'll burn 50% of the LP tokens, but keep the other 50%, essentially still owning 100% of the liquidity and therefore can easily rug the project.

Yous Tin Always Attain OUT AND Inquire

Feel free to find the project'southward Discord or Telegram group and inquire with the developers and/or projection members about what'due south going on with a specific address and/or TX.

Hopefully, they tin can provide y'all with a satisfactory answer. Be suspicious of whatever sort of response that feels like disregard or trying to sweep it under the carpet, equally this should brand you lot distrustful of their intentions.

Address 3 in the image in a higher placeare the LP tokens on Pancakeswap which are used for buying and selling.

The other addresses might be wallets that are used for "PR" purposes, "Dev funds", or they may only exist normal people who bought large shares of the tokens.

Pinnacle receivers (from developer wallets)

Sometimes, the developers will distribute their tokens across multiple wallets to obfuscate the fact they still own the tokens.

What to practice?

Check to see if the programmer wallet sent even or like-kind amounts of tokens to other wallets —- these transactions usually take place all at the same time or within a short period of ane another.

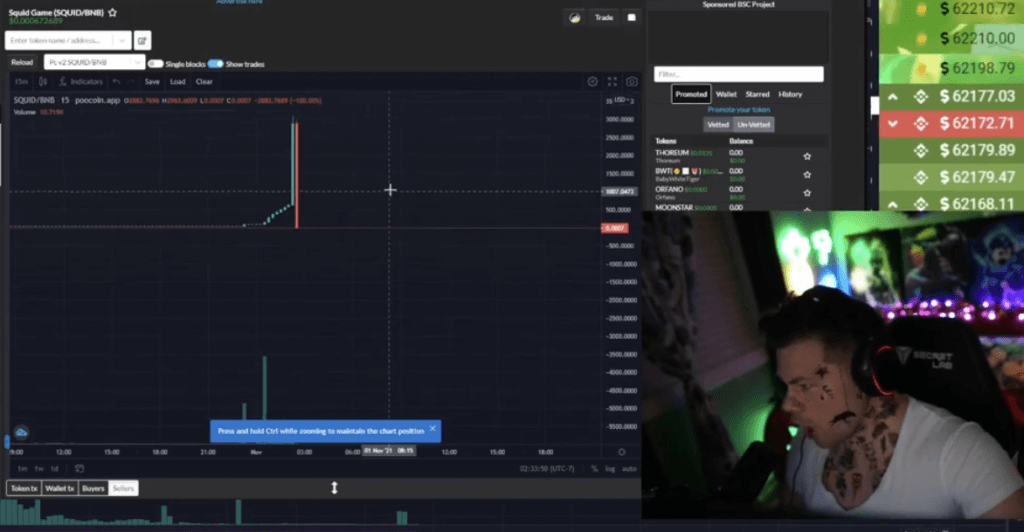

Another trick is to see who made buys/purchases correct later on the LP token was created. If a large buy happens within the first few minutes of creating the LP token, it is probably one of the programmer's wallets and indicates a potential scam or rug.

You tin can use https://poocoin.app/rugcheck to bank check for top receivers.

Scam coin or not? Do a test (dip your toe in)

If you're interested in a token and call back it's really gonna run and don't want to exist left behind, just do a simple exam.

Buy the smallest amount possible and and then try to sell it. If y'all're able to buy and sell without any problems, this might indicate the project is non a honeypot.

This simple exam is an like shooting fish in a barrel and quick way to potentially save yourself from losing massive amounts of your funds to honeypots!

The Most Ideal Situation… and Tying it all Together

When researching newest cryptocurrency, ideally, the all-time tokensshould take the following criteria:

- nearly 100% of the tokens turned into an LP token on the exchange

- no pre-auction

- no mint function

- no self destruct office

- renounced ownership of the contract

- burnt 100% of LP tokens/and or some type of liquidity lock for a period of time

Needless to say, even tokens that check all of these boxes may air current up flopping considering they lack traction on social media, or basically, no one knows about them, and they never gain plenty exposure.

And so just because the token looks nifty may not mean information technology'll run. This also applies to the reverse situation, where a token may not check all the safety guidelines but has a lot of hype and neat social presence, therefore assuasive it to gain a lot of traction and run hard.

That being said, these are only some 'general' guidelines, and the rules can be broken, of course. The next large cryptocurrency may take legitimate reasons for non renouncing ownership or keeping lots of tokens out of the LP pool for things like developer funds, promotions, early investors, and and then on.

Simply because something doesn't meet these ideal conditions doesn't mean it's not a great project or a hidden gem, as we all know nosotros don't live in an ideal world.

Conclusion

The altcoin world in a lot of means is similar the Wild W — full of potential and amazing rewards, simply also somewhat lawless and riddled with scammers and potential threats.

Hopefully, this two-part series has given y'all the tools you need to avert scams, and go the about out of ListingSpy!

Once once more, this isn't a 100% comprehensive guide, and it'due south impossible to fully avoid scams if y'all are active in the space, simply by following role I and role Two you're likely to eliminate most scams. We say this because scammers are constantly coming upwards with new tricks and ideas to fool other crypto users!

Remember: All newest coins should be treated as buyer beware, anddoing your own research is i of the best means to protect from scams and keep your profits secure from the prying easily of swindlers and scammers!

Best crypto tin be found early with prudent due diligence and tools like ListingSpy with its awesome scam filter, real fourth dimension listings, sorting, and other features, and various tools like Token Sniffer and Etherscan/BscScan. Scam coins can be avoided (at least most of them!) when y'all employ cracking crypto analytics tools and have a skilful process to follow.

If yous are still using a Free version of ListingSpy, please consider upgrading to Standard, Premium or Exclusive to get admission to more powerful features.

Don't forget to bank check us out on Twitter for updates and promotions – https://twitter.com/ListingSpy

Join our community on Telegram to chat with us or other customs members nigh hidden gem tokens – https://t.me/listingspynet

Best of luck Spys!

Source: https://listingspy.net/blog/en/how-to-avoid-crypto-scams-part-2

Posted by: matthewssagem1938.blogspot.com

0 Response to "How To Put On Merle Norman Check Crayon"

Post a Comment